If you’ve been watching from the sidelines, now’s the time to lean in. It’s officially the best time to buy this year. According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025:

“By mid-October, buyers may finally find the combination of inventory, pricing, and negotiating power they’ve been waiting for—a rare opportunity in a market that has been tight for most of the past decade.”

So, if you’re ready and able to buy this month this means you should see:

- More homes to choose from

- Less competition from other buyers

- More time to browse

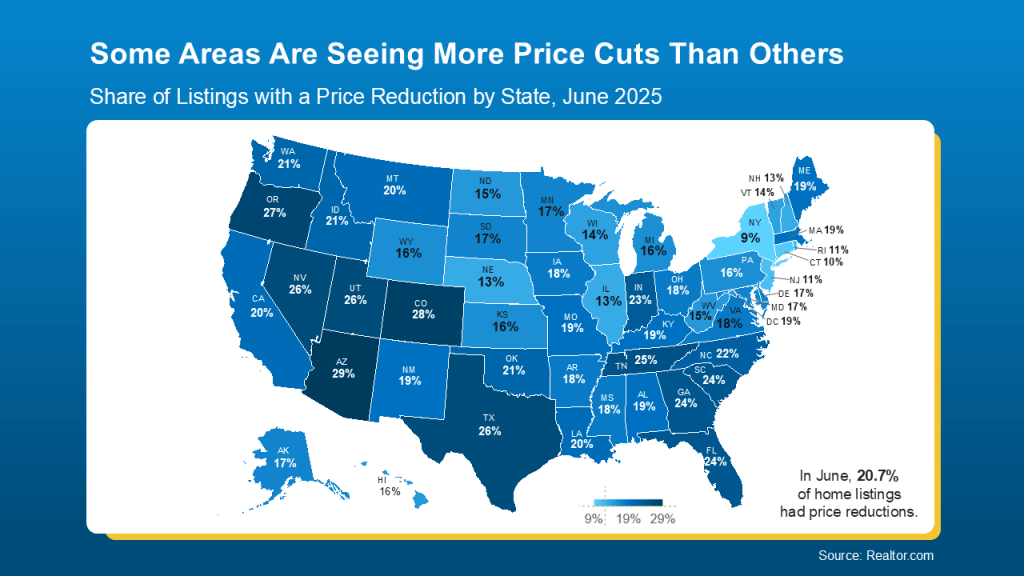

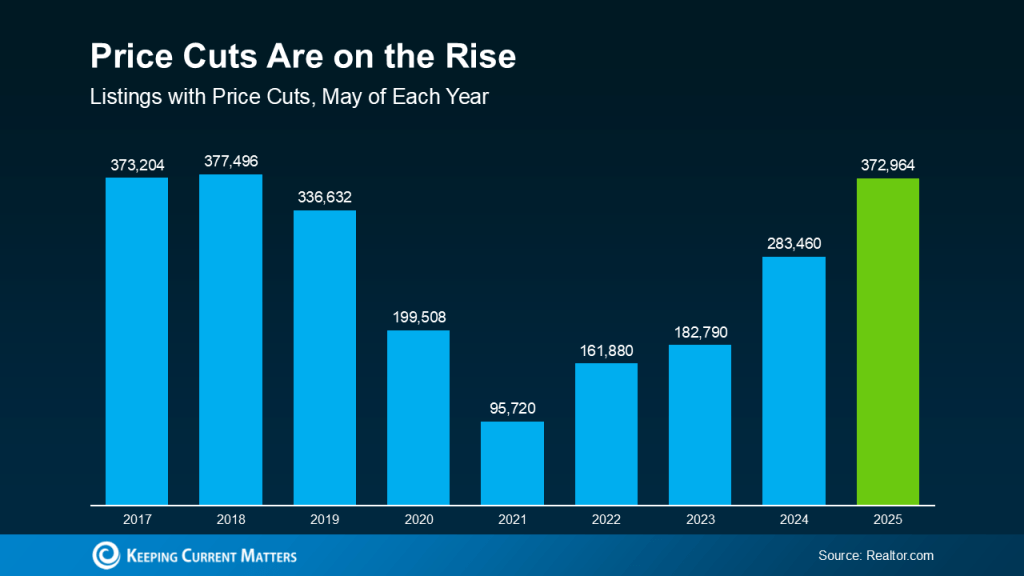

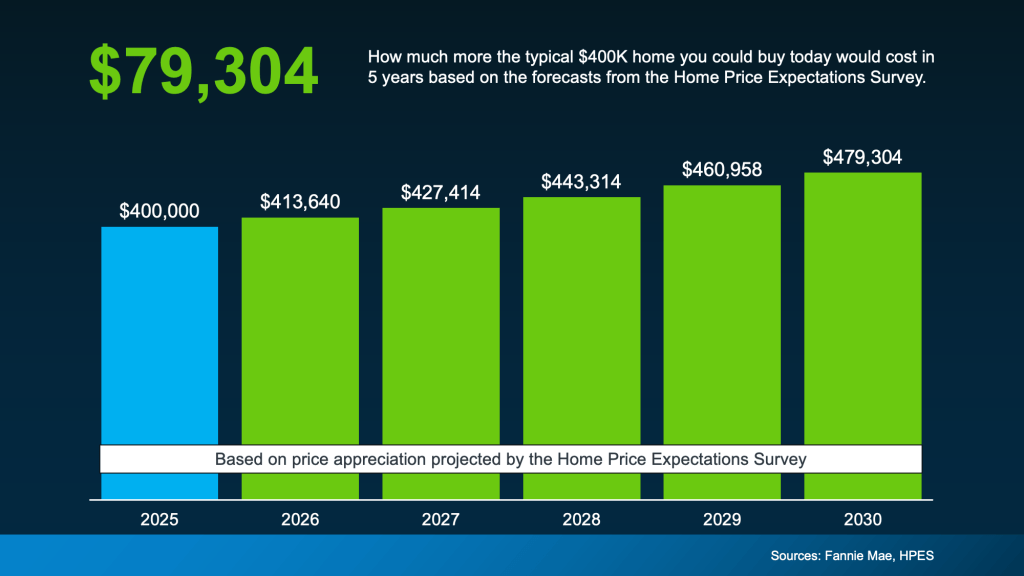

- Better home prices

- Sellers who are more willing to negotiate

While October 12-18 is the national “best week,” conditions are in place now for buyers who have been waiting to upsize, downsize or right size to find the properties they’ve been looking for at prices that they’re willing to pay.

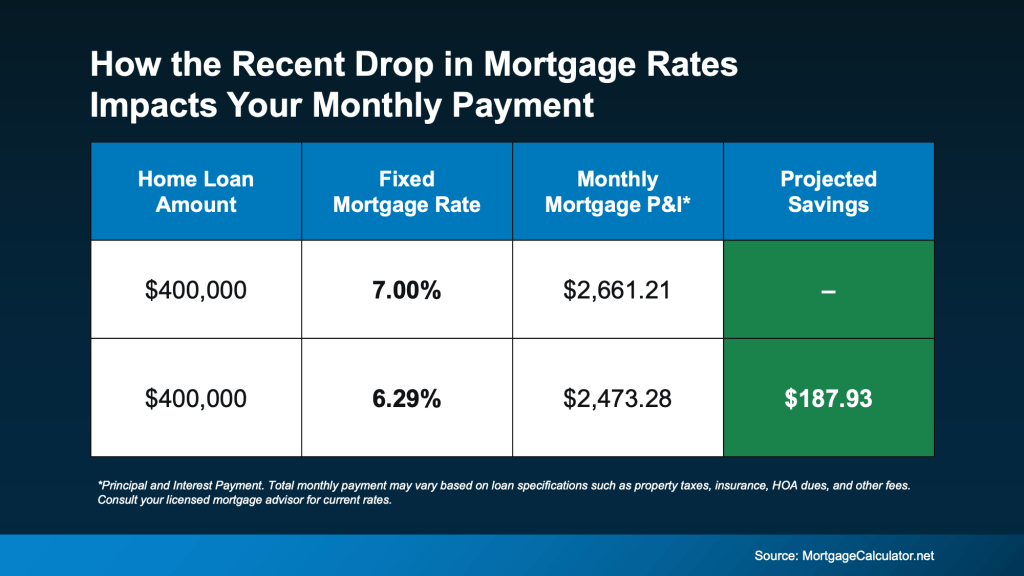

Here on Cape Cod, inventory is increasing as are days on market for listed properties. This means sellers should be interested in negotiating prices and terms so they can move on with their lives. Mortgage interest rates are also the lowest that they have been in a year helping buyers afford what are still high prices.

And remember home prices are lower elsewhere in other parts of Massachusetts, as well as New England and the country as a whole. So, you don’t have to limit your search to just on Cape. Through the various connections we have with realtors off Cape and elsewhere, we can refer you to a very qualified Realtor who can help you with your search.

What the Experts Are Saying

Realtor.com isn’t the only one saying you’ve got an opportunity if you move now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Daryl Fairweather, Chief Economist at Redfin, puts it like this:

“Nationally, now is a good time to buy, if you can afford it . . . with falling mortgage rates and significantly more inventory, buyers have an upper hand in negotiations.”

And NerdWallet says:

“This fall just might be the best window for home buyers in the past five years.”

How To Get Ready

To make sure you’re ready to jump, talk to us now. We can give you the information you need to decide if this is the time for you to buy. We can discuss timing, strategy, and how you may be able to buy your new home before selling your current one.

You can find us at 508-388-1994 or msennott@todayrealestate.com. We’re here to help…

BTW…Hank’s new book of short stories will be available soon. Please watch for it. Copies “signed by the author” can be purchased via Venmo. Contact Mari for details. Thanks.

Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.