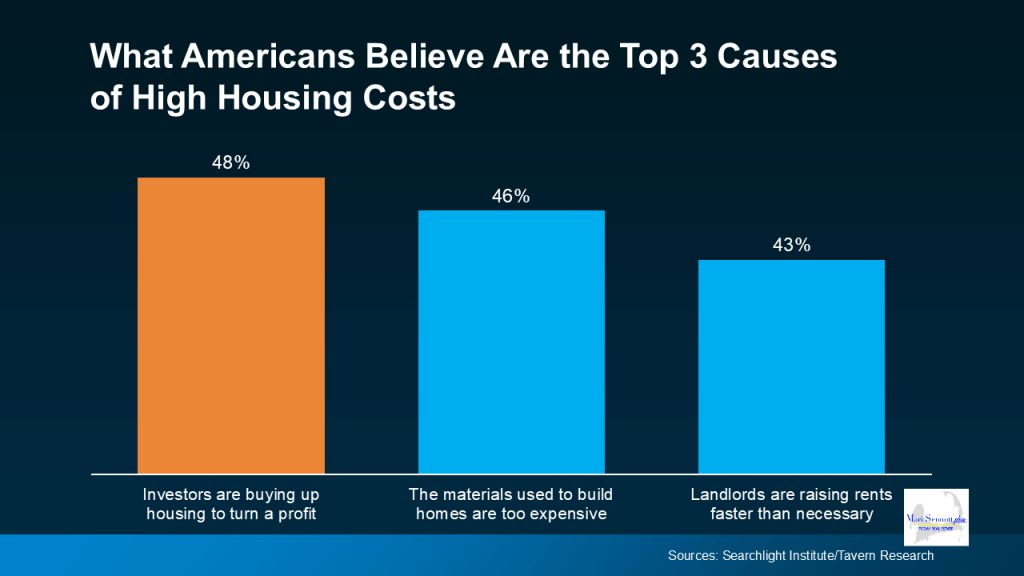

Scroll through your feed and you’ll see plenty of finger-pointing about why homes cost so much. And according to a national survey, a lot of people believe big investors are to blame.

Even though data shows that’s not true, nearly half of Americans surveyed think investors are the top reason housing feels so expensive (see graph below):

But that opinion doesn’t hold up if you look at the data.

The Truth About Investors

Investors do play a role in the housing market, especially in certain areas. But they’re not buying up all the homes like so many people on social media say.

Nationwide, Realtor.com found only 2.8% of all home purchases last year were made by big investors (who own more than 50 properties). That means roughly 97% of homes were bought and sold by regular people, not corporate giants. Danielle Hale, Chief Economist at Realtor.com, explains:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

The majority of “investors” are people like many of us who own a second home, or who have purchased a few properties as an investment. They’re not big, bad, faceless corporations.

So, if it’s not investors, why are home prices so high?

What’s Really Behind Today’s Home Prices

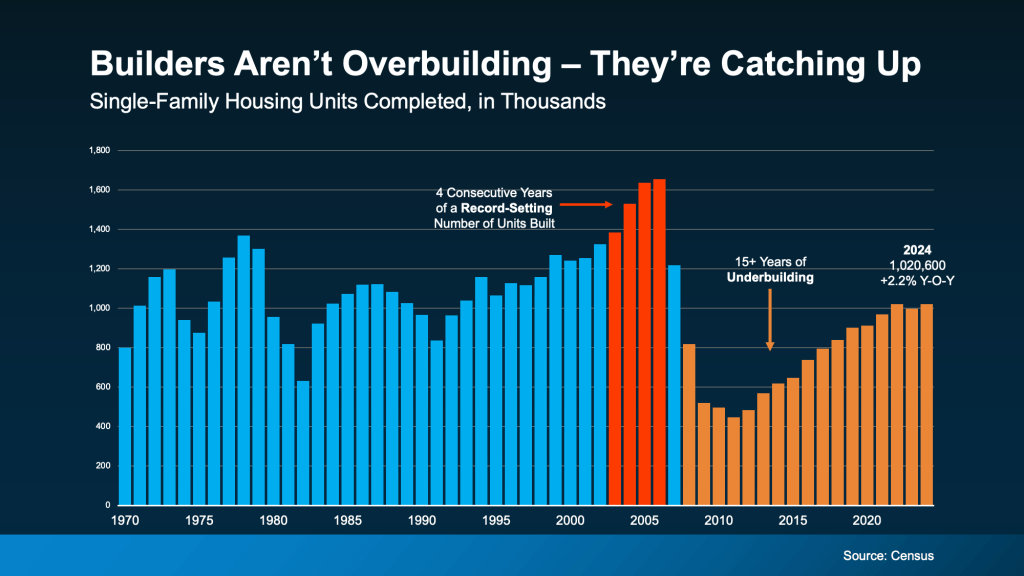

The real story behind rising prices has less to do with who’s buying and more to do with what’s missing: enough homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), says:

“It’s been popular among some to blame investors, but with housing, the economics of that don’t make a lot of sense. The fundamental driver of housing costs is the shortage itself—it’s driven by the fact that there’s a mismatch between the number of households and the actual size of the housing stock.”

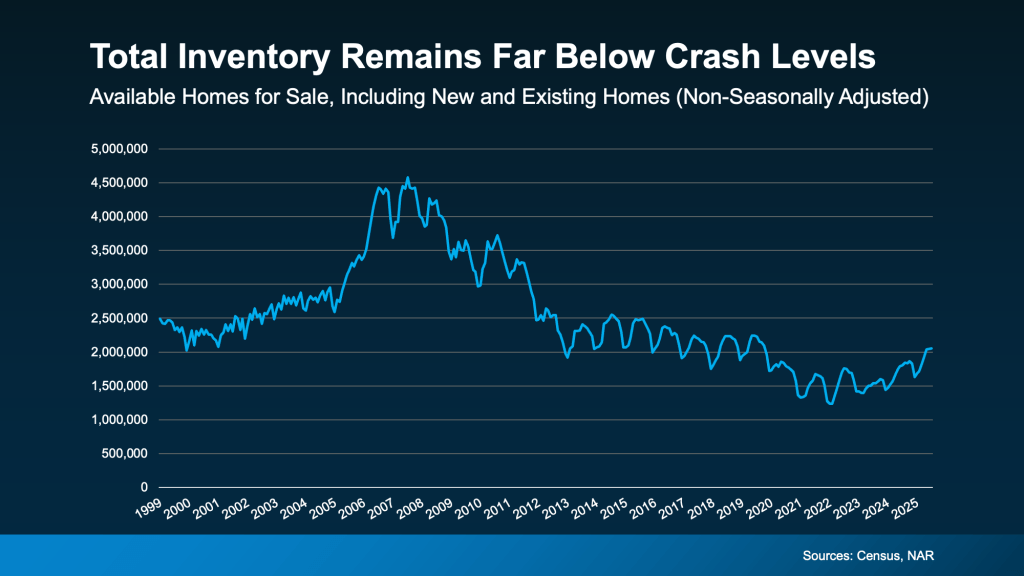

There simply haven’t been enough homes for sale to meet buyer demand. And that shortage, not investor activity, is what’s pushed prices higher just about everywhere.

Bottom Line

It’s easy to believe investors caused today’s housing challenges. But the truth is, the market just needs more homes, and that’s finally starting to happen as inventory is increasing.

As more options hit the market, buying may feel a bit more realistic again for those of you who have been waiting.

We can tell you what happening on Cape Cod and over the bridges, as well. You can find us at 508-388-1994 or msennott@todayrealestate.com.

We’re here to help.

Mari and Hank

Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.