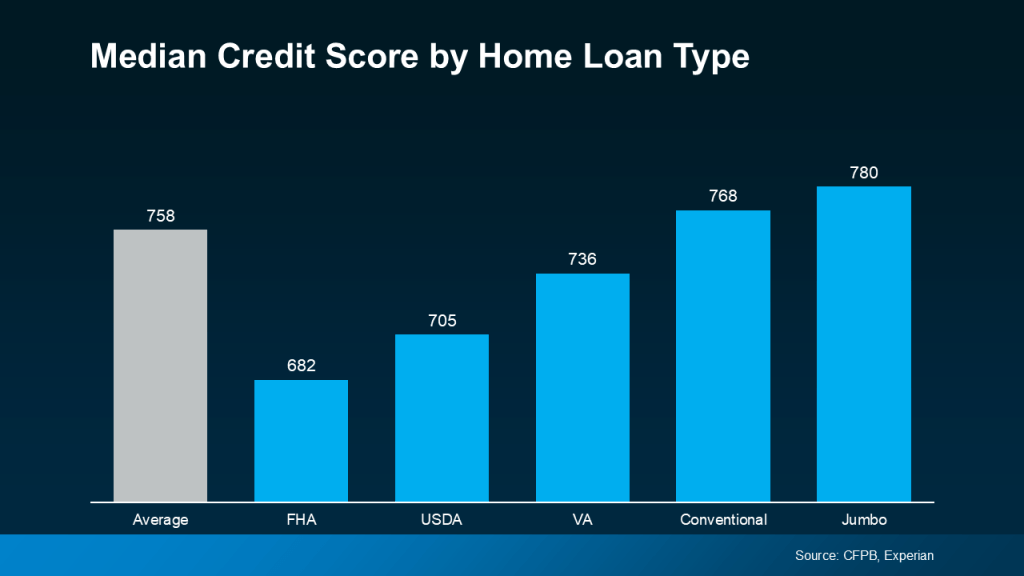

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed.

Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you think buying a home is out of reach for you right now, even if that’s not necessarily true. So, let’s look at what the data really says about credit scores and homebuying.

There’s No One Magic Number

There’s no universal credit score you absolutely have to have when buying a home. And that means there’s more flexibility than most people realize. Check out this graph showing the median credit scores recent buyers had among different home loan types:

Here’s what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

Why Your Score Still Matters

When you buy a home, lenders use your credit score to get a sense of how reliable you are with money. They want to see if you typically make payments on time, pay back debts, and more.

Your score can impact which loan types you may qualify for, the terms on those loans, and even your mortgage rate. And since mortgage rates are a big factor in how much house you’ll be able to afford, that may make your score feel even more important today. As Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

That still doesn’t mean your credit has to be perfect. Even if your credit score isn’t as high as you’d like, you may still be able to get a home loan.

Want To Boost Your Score? Start Here

And if you talk to a lender and decide you want to improve your score (and hopefully your loan type and terms too), here are a few smart moves according to the Federal Reserve Board:

- Pay Your Bills on Time: This is a big one. Lenders want to see you can reliably pay your bills on time. This includes everything from credit cards to utilities and cell phone bills. Consistent, on-time payments show you’re a responsible borrower.

- Pay Down Your Debt: When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible. That makes you a lower-risk borrower in the eyes of lenders – making them more likely to approve a loan with better terms.

- Review Your Credit Report: Get copies of your credit report and work to correct any errors you find. This can help improve your score.

- Don’t Open New Accounts: While it might be tempting to open more credit cards to build your score, it’s best to hold off. Too many new credit applications can lead to hard inquiries on your report, which can temporarily lower your score.

Bottom Line

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where you stand and your options for a mortgage is to connect with a trusted lender.

If you are not working with a reputable lender, we can connect you with several who we know. Just reach out to 508-388-1994 or msennott@todayrealestate.com. We’re happy to help…

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.