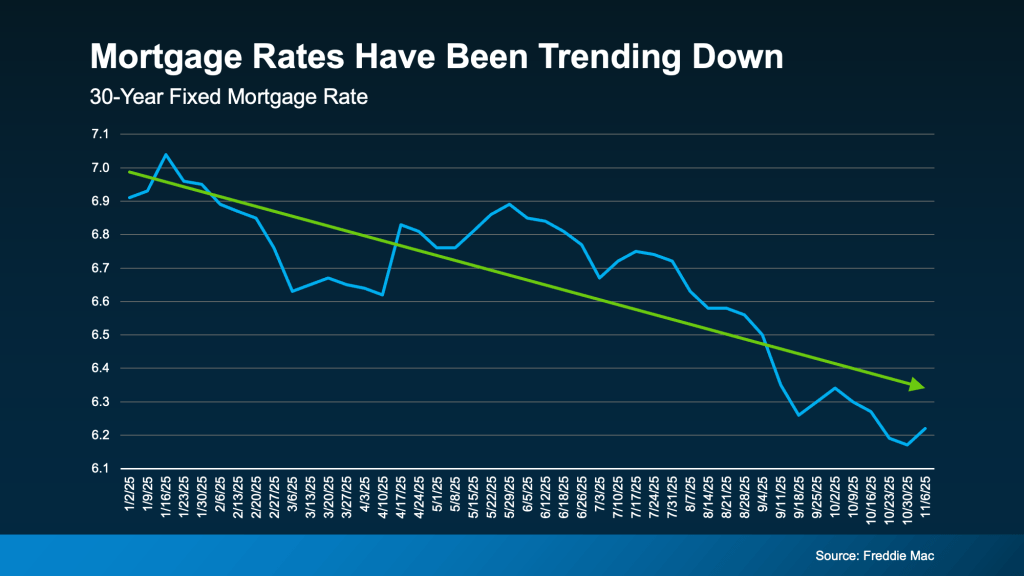

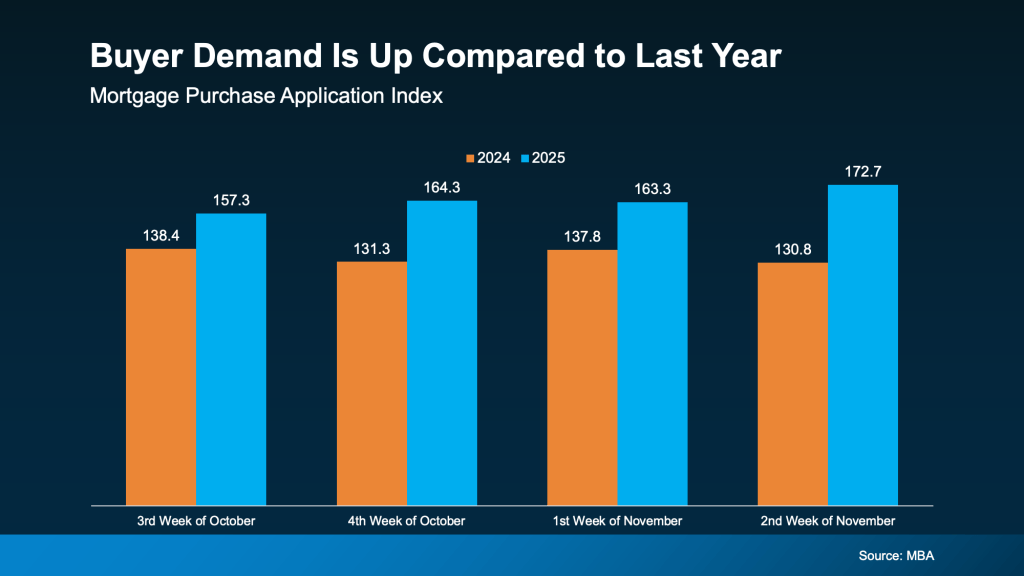

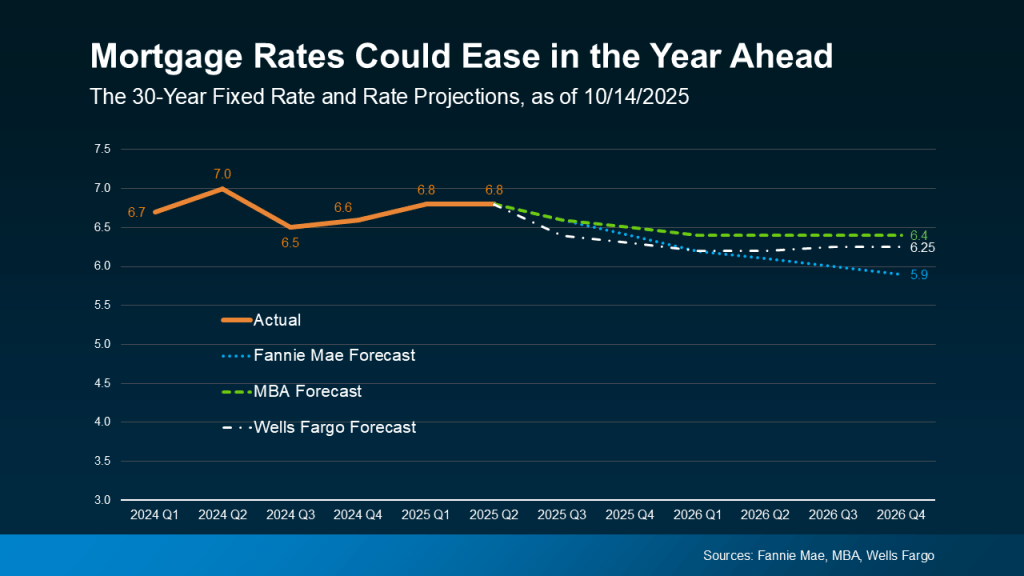

If you’re one of the thousands of homebuyers waiting for rates to fall, you should know it’s already happening. Rates recently crossed an important milestone when they officially dipped their toes into the 5s – something that hasn’t happened in about three years.

This moment marked a critical threshold. Now, rates are sitting in the low 6% territory. And forecasts by the experts project they’ll hover near this range throughout the year.

Here’s why that’s so good for you.

Why It’s Such a Big Deal

A mortgage rate impacts more than just the interest you pay on your home loan. It shapes your entire buying experience.

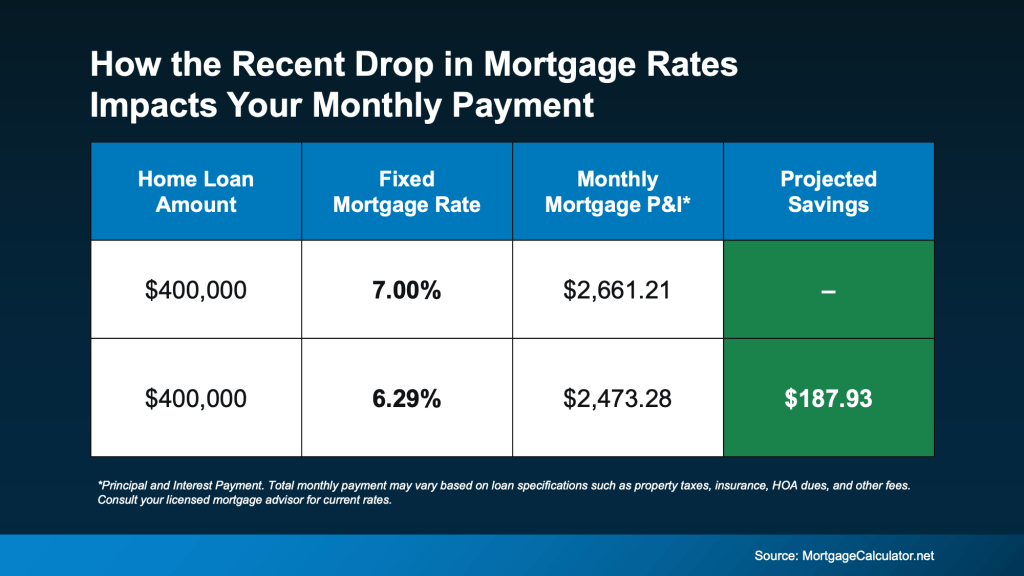

When rates were up around 7% just one year ago, a lot of buyers felt priced out. Payments were higher. Budgets felt tighter. Affordability was a bigger challenge. That’s especially true for first-time homebuyers, who felt the biggest pinch.

But according to industry experts, that’s starting to change now that rates are slowly inching down. Let’s break down why.

Right now, borrowing costs are in their lowest range in almost three years. And that can change the type of home you can afford.

At 6% or below, you’ll see:

- Lower monthly payments. The payment on a $400k home loan is down over $300 compared to when rates were around 7%.

- More buying power, thanks to the extra breathing room in your budget.

So, you can now make a stronger offer, purchase in a different location, or buy a home that checks more of your boxes. And that feels like a big shift compared to when rates were at 7%.

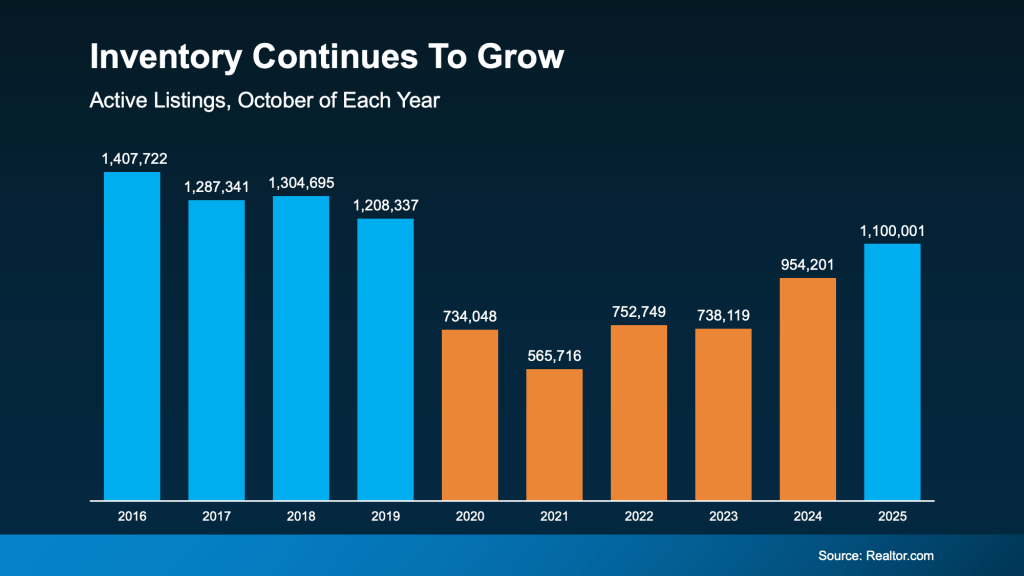

This Opens the Door for Millions of Buyers

To drive home just how much this helps potential homebuyers, consider research from the National Association of Realtors (NAR). It shows that when mortgage rates are at this level, millions more households can afford a home. When rates are at 6% or below:

- 5.5 million more households can afford the median-priced home

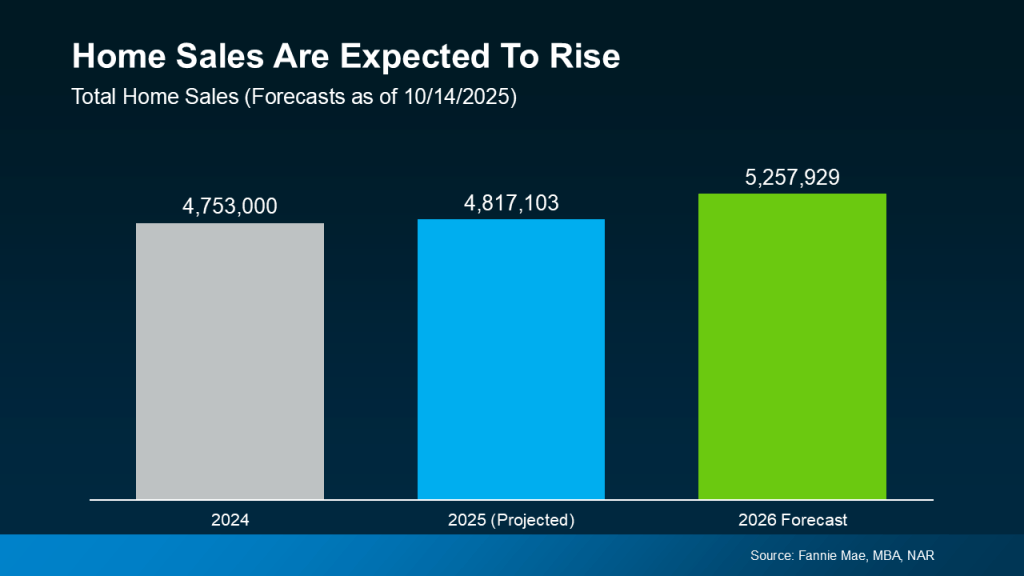

- And roughly 550,000 of those people will likely buy a home within 12 to 18 months

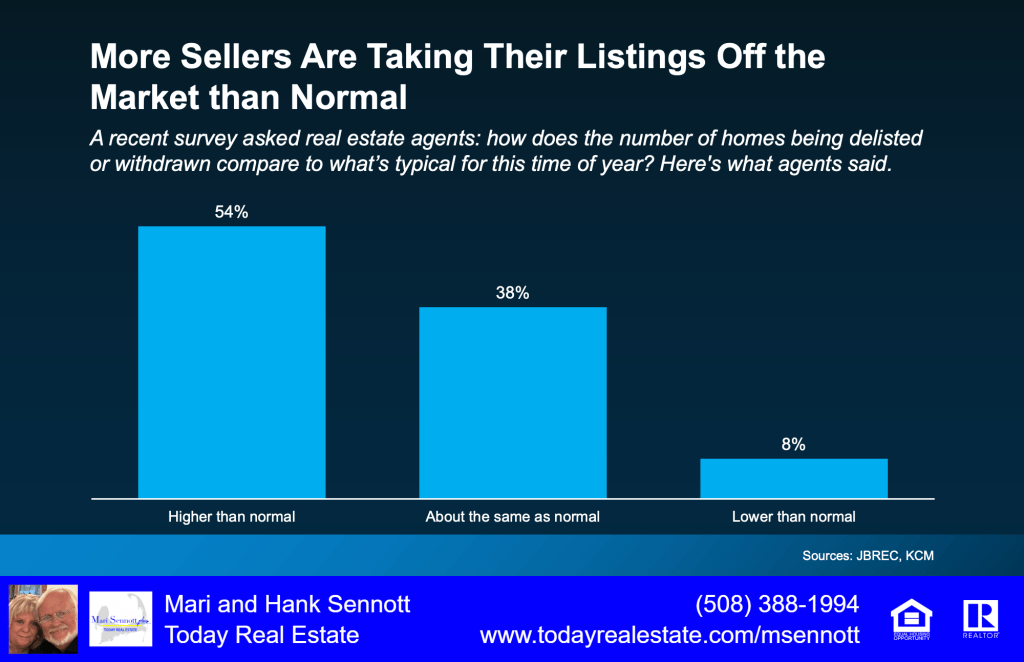

This isn’t speculation. That’s pent-up demand finally getting a green light. You have the chance right now to get ahead and buy before more people notice the game has changed.

Because whether rates stay in the low 6s or dip back down into the upper 5s, the math is already working in your favor. And the difference from a low 6% to a high 5% isn’t as big as you may think. But the difference from 7% to 6%? That is a very big deal, and it’s a number that’s already working in your favor.

Mortgage rates don’t operate in a vacuum. Home prices, local inventory, property taxes, home insurance, and your personal finances still matter.

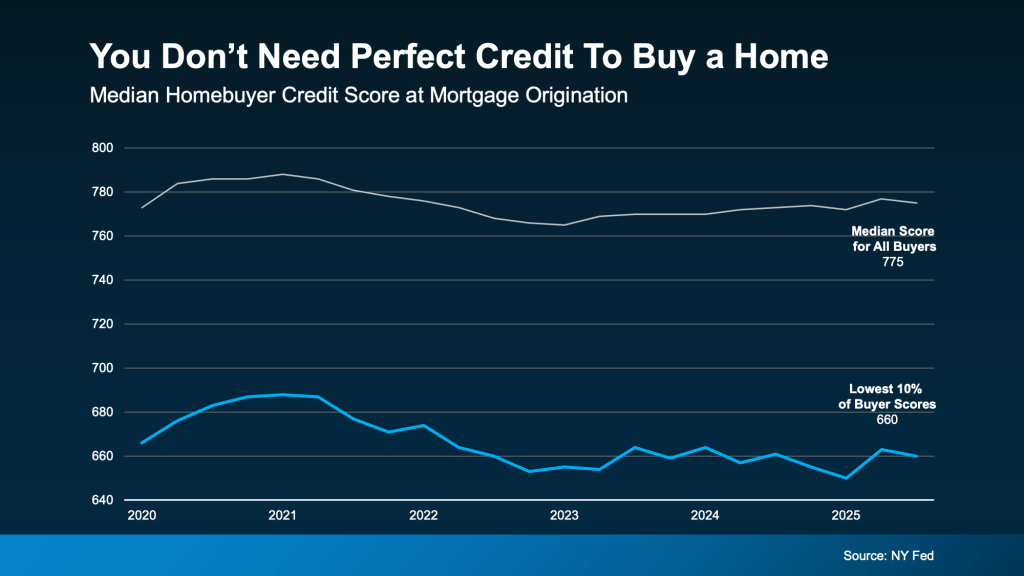

Remember a rate in this territory doesn’t mean every home suddenly works for every buyer. That’s why getting pre-approved and running your numbers with a trusted lender is key. If you do not have a lender, please let us know. We can recommend several.

Bottom Line

Mortgage rates dropping to a 3-year low isn’t just a headline.

For many buyers, where rates are now could be the difference between watching from the sidelines and finally getting the keys to their next home.

If you’ve been waiting for a sign to re-run your numbers and see what’s possible now, this is it.

Let’s connect and take a look at what today’s rates mean for your budget and your options.

Mari, Hank, and Colleen

508-388-1884 (Mari and Hank)

781-423-8662 (Colleen)

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.