Think again.

Maybe you’ve seen headlines saying home sales are down compared to last year. You might even be thinking – is it even a good time to sell?

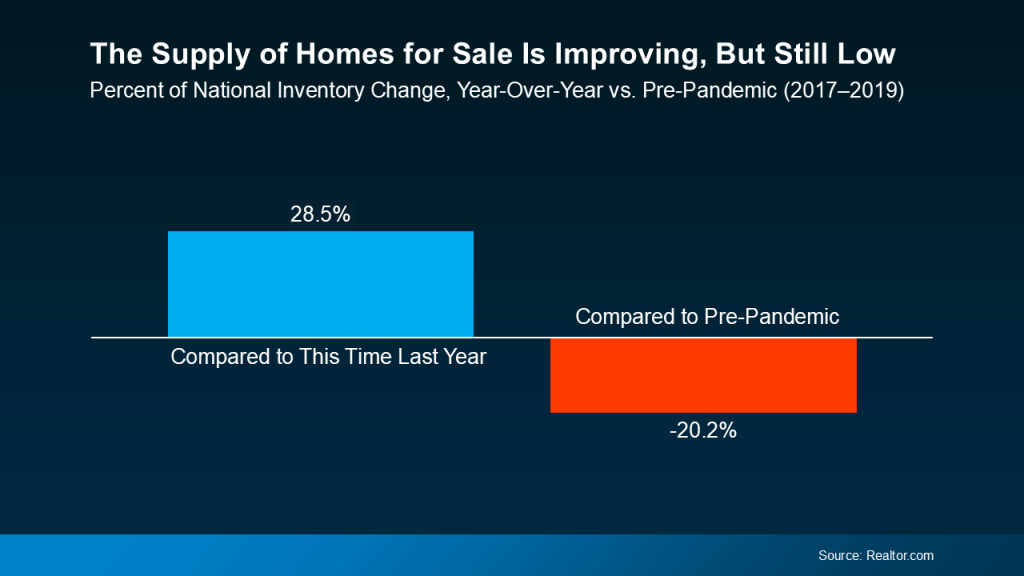

Here’s the thing. There’s no denying that the pace of the market has cooled compared to the frenzy we saw just a few years ago. Cumulative days on market for 2025 is 61 as opposed to 47 one year ago. But that’s not a red flag. It’s a return to normal. And normal doesn’t mean nothing’s happening. Buyers are still out there – and homes are still selling.

Why? Because real life doesn’t pause for perfect conditions. There are always people who need to buy – and this year is no exception. Buyers who are in the middle of a big change in their lives, a new marriage, a growing family, or a new job still need to move, no matter where mortgage rates are. And they may be looking for a home just like yours.

Every Minute 8 Homes Sell

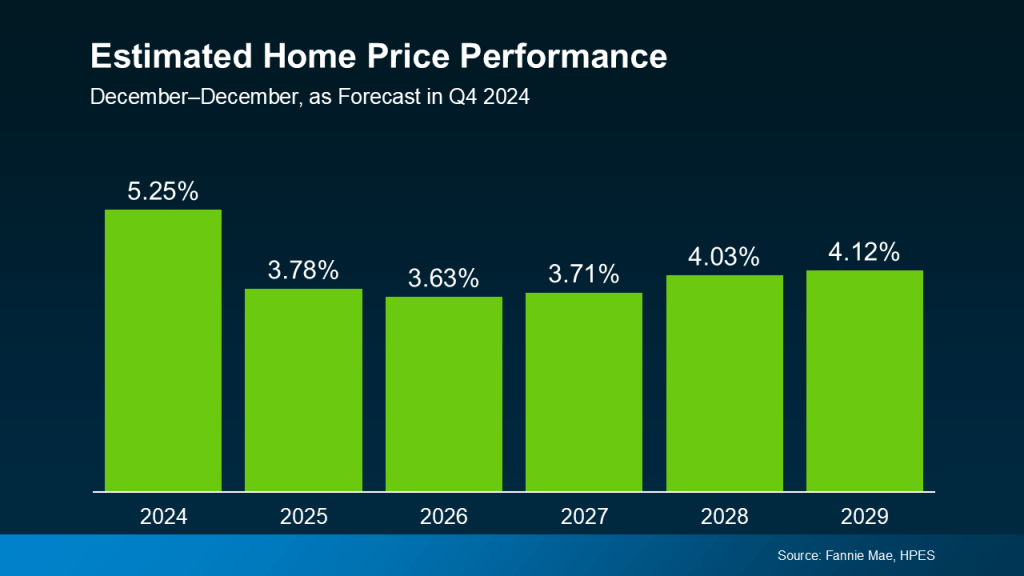

Let’s break it down using the latest sales from the National Association of Realtors (NAR). Based on the current pace, we’re on track to sell 4.03 million homes this year (not including new construction).

- 4.03 million homes ÷ 365 days = 11,041 homes sell per day

- 11,041 homes ÷ 24 hours = 460 homes sell per hour

- 460 homes ÷ 60 minutes = roughly 8 homes sell every minute

That means in the time it takes to read this; another 8 homes will sell. Let that sink in. Every minute, buyers are making moves – and sellers are closing deals.

If you’ve been holding off on selling your house because you think buyers aren’t out there, let this reassure you – there are still buyers looking to buy.

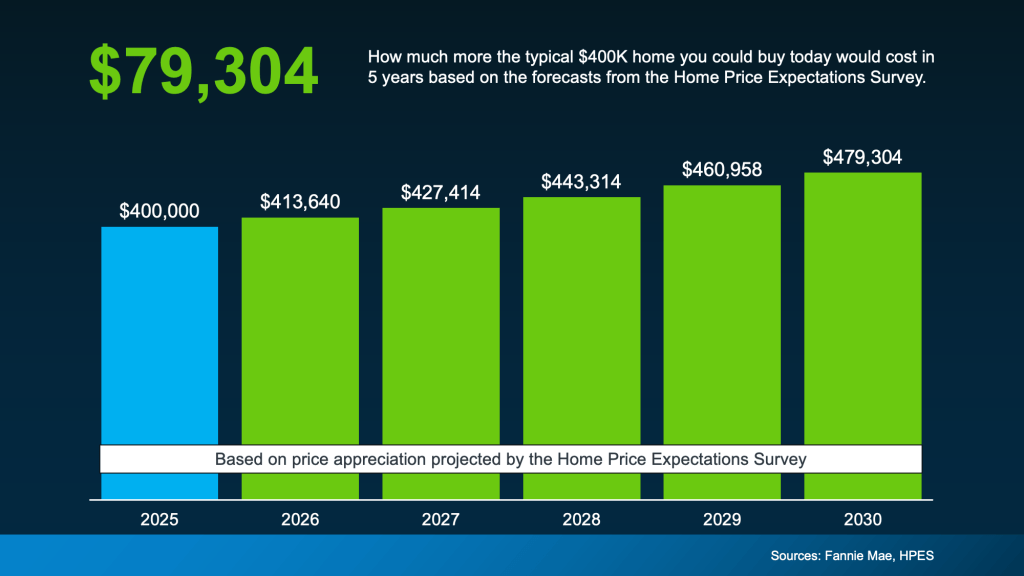

On Cape Cod more than 900 single family homes have closed this year with nearly 1,100 more pending. The median sales price for the year thus far is $756,490.00. That’s 3% higher than last year.

Remember: median sales price is the midway point. There are just as many homes for sales below the median price as above.

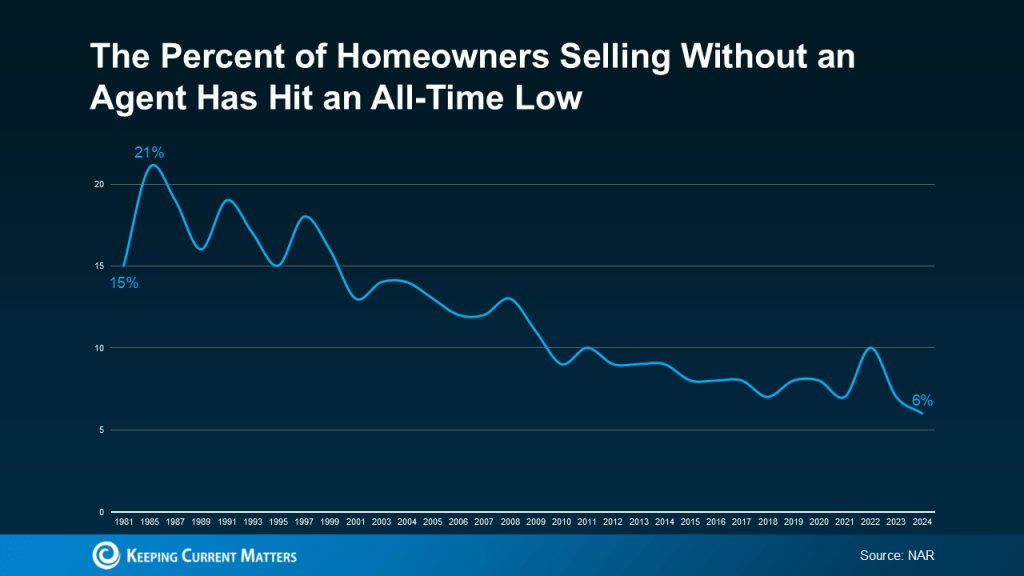

But since the market is balancing out, selling today takes more than just putting up a sign in the yard. You’ve got to price your house right, market it well, and know how to reach the buyers who are ready to act. That’s where we come in.

We’ll help you navigate this market, position your home to stand out, and guide you through every step.

We know the market so we also can assist you in finding the right home that meets your goals.

Bottom Line

The market hasn’t stopped. Buyers are still buying. Life is still happening. And if selling your home or buying one (or both!) is part of your next chapter, you can make it happen.

Roughly 11,000 homes are selling every day. When you’re ready to make the change you need to, let’s connect at 508-388-1994 or msennott@todayrealestate.com and we’ll start working on where’s next for you.

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.