Selling your house without an agent as a “For Sale by Owner” (FSBO) may be something you’ve considered. Everyone knows someone who knows someone who sold a home on their own and everything went “just fine.”

But did it really?

Did they leave money on the table? Agree to a concession that they didn’t need to? Spend too much on legal fees? When it was all over, how much money did they really save by not hiring a real estate professional to manage the sale??

You don’t hear much about any of that because maybe the “successful” seller doesn’t understand what they lost.

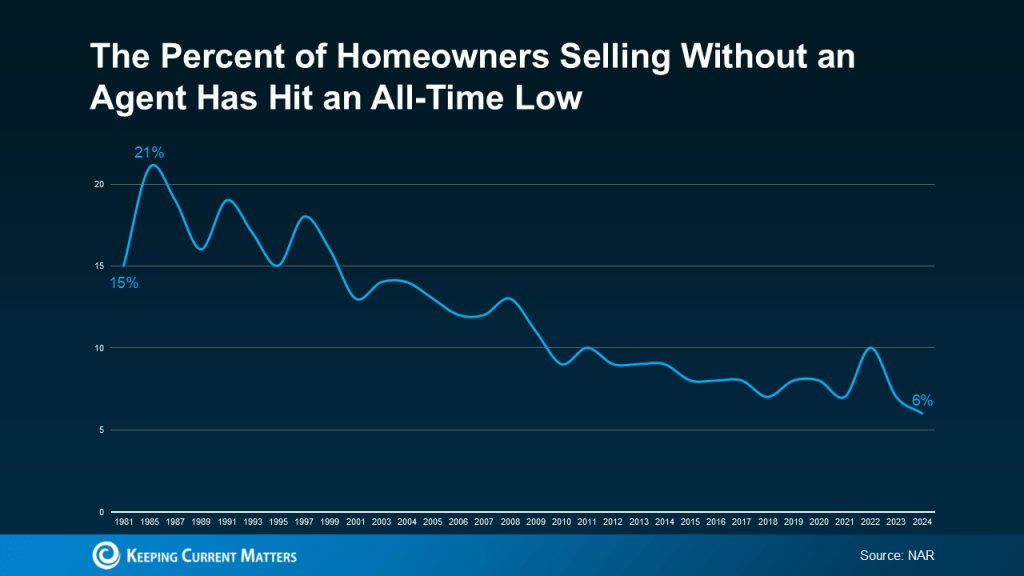

Here’s what you need to know. In today’s shifting market, more homeowners are deciding that it’s not worth the risk to go it alone.

According to the latest data from the National Association of Realtors (NAR), the number of homeowners selling without professional assistance has hit an all-time low (see graph below):

And for the small number of homeowners who do decide to sell on their own, data shows they’re still not confident they’re making a good choice.

A recent survey finds three out of every four homeowners who don’t plan to use an agent have doubts about whether that’s actually the right decision.

And here’s why. The market is changing – not in a bad way, just in a way that requires a smarter, more strategic approach. And having a professional in your corner really pays off.

Here are just two of the ways our expertise makes a difference.

1. Getting the Price Right in a Market That’s Evolving

One of the biggest hurdles when selling a house on your own is figuring out the right price. It’s not as simple as picking a price that you want, sounds good, or is what your neighbor’s home sold for a few years back – you need to hit the bullseye for where the market is right now. Without professional to help, you’re more likely to miss. As Zillow explains:

“Agents are pros when it comes to pricing properties and have their finger on the pulse of your local market. They understand current buying trends and can provide insight into how your home compares to others for sale nearby.”

Basically, we know what’s really selling, what buyers are willing to pay today, and how to position your house to sell quickly. That kind of insight can have a big impact, especially in a market that’s balancing out.

2. Handling (and Actually Understanding) the Legal Documents

There’s also a mountain of documentation when selling a house, including everything from disclosures to seller and buyer contracts. A mistake can have big legal implications. This is another area where we can help.

We’ve handled these documents countless times and know exactly what’s needed to keep everything on track, so you avoid delays. And now that buyers are including more contingencies and asking for concessions again, we can guide you step by step, making sure everything is done right and documented correctly the first time.

Selling Your House Quickly in a Shifting Market

Even though inventory has grown, homes aren’t selling at quite the same pace as they were. But you can still sell quickly if you have a proven plan to help your house stand out.

Just remember, as a homeowner you don’t have the same network or marketing tools that we do. Selling a house is more than sticking a sign in the ground and putting a posting on Facebook.

We’ve sold over 400 homes.

So, if you want the process to happen in a timely manner, let’s connect at 508-388-1994 or msennott@todayrealestate.com.

Mari and Hank