We hope you were able to enjoy the Labor Day Weekend with family and friends.

When people get together it’s pretty common for them to talk about the issues of the day and everyone loves to talk about the real estate market.

Your Uncle Bob who “knows a little something about real estate” may have commented over the weekend that new home inventory is at its highest level since the crash. And that was a bad sign.

If you lived through the crash back in 2008, hearing that new construction is up may feel a little scary.

But here’s what you need to remember: a lot of what you see online is designed to get clicks. Of course, the more sensational the more likely the headline is to be repeated by people like your Uncle Bob. (With all due respect to everyone’s Uncle Bob!)

So, you may not be getting the full story. A closer look at the data and a little expert insight can change your perspective completely.

Why This Isn’t Like 2008

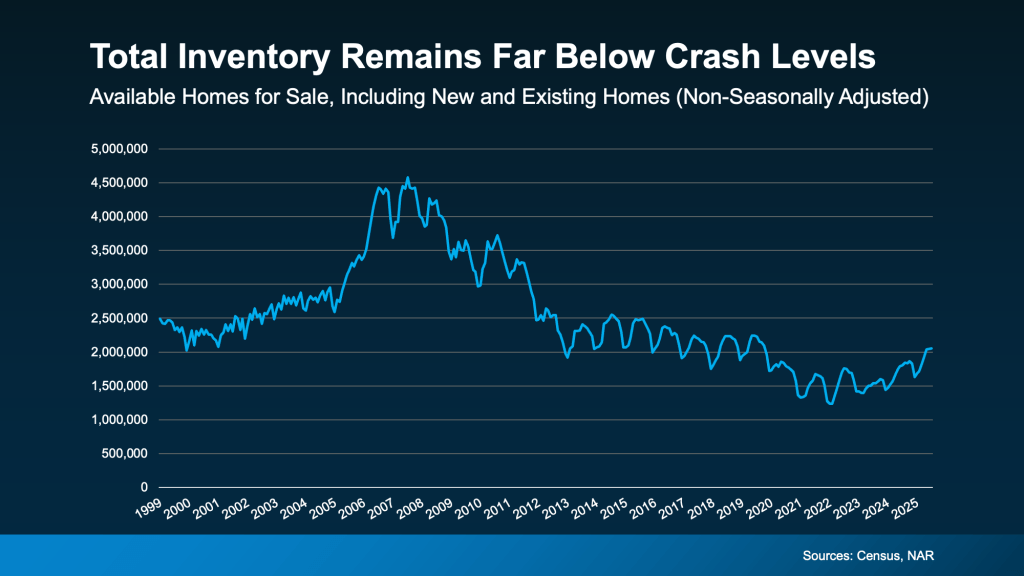

While it’s true the number of new homes on the market hit its highest level since the crash, that’s not a reason to worry. That’s because new builds are just one piece of the puzzle. They don’t tell the full story of what’s happening today.

To get the real picture of how much inventory we have and how it compares to the surplus we saw back then, you’ve got to look at both new homes and existing homes (homes that were lived in by a previous owner).

When you combine those two numbers, it’s clear overall supply looks very different today than it did around the crash (see graph below):

So, saying we’re near 2008 levels for new construction isn’t the same as the inventory surplus we had the last time.

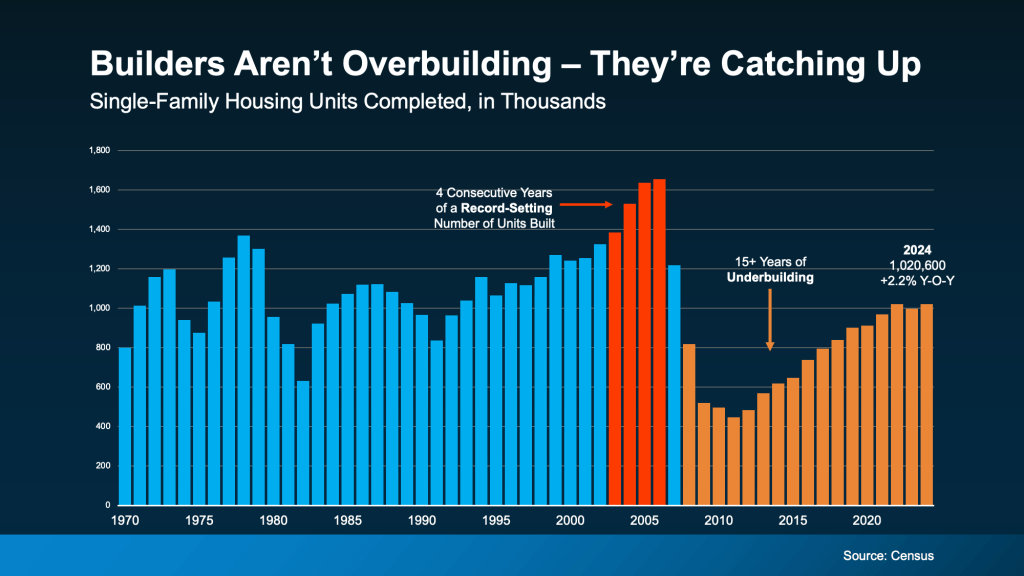

Builders Have Actually Underbuilt for Over a Decade

And here’s some other important perspective you’re not going to get from those headlines. After the 2008 crash, builders slammed on the brakes. For 15 years, they didn’t build enough homes to keep up with demand. That long stretch of underbuilding created a major housing shortage, which we’re still dealing with today.

The graph below uses Census data to show the overbuilding leading up to the crash (in red), and the period of underbuilding that followed (in orange):

Basically, we had more than 15 straight years of underbuilding – and we’re only recently starting to slowly climb out of that hole. But there’s still a long way to go (even with the growth we’ve seen lately). Experts at Realtor.com say it would roughly 7.5 years to build enough homes to close the gap.

Of course, like anything else in real estate, the level of supply and demand is going to vary by market. Some markets may have more homes for sale, some less. But nationally, this isn’t like the last time.

Bottom Line

Just because there are more new homes for sale right now, it doesn’t mean we’re headed for a crash. The data shows today’s overall inventory situation is different.

If you have questions or want to talk about what builders are doing on Cape Cod, let’s connect at 508-388-1994 or msennott@todayrealestate.com.

We’ll talk to Uncle Bob, too!

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.