This week many of us will be gathering with family and friends to celebrate Thanksgiving.

If you’re think about buying a home for the first time or selling your current one to upsize, downsize or move to that “someday” neighborhood, well-meaning relatives and friends — like your Uncle Bob who “knows a little something about real estate” — will have their opinions.

So, here’s what you need to know.

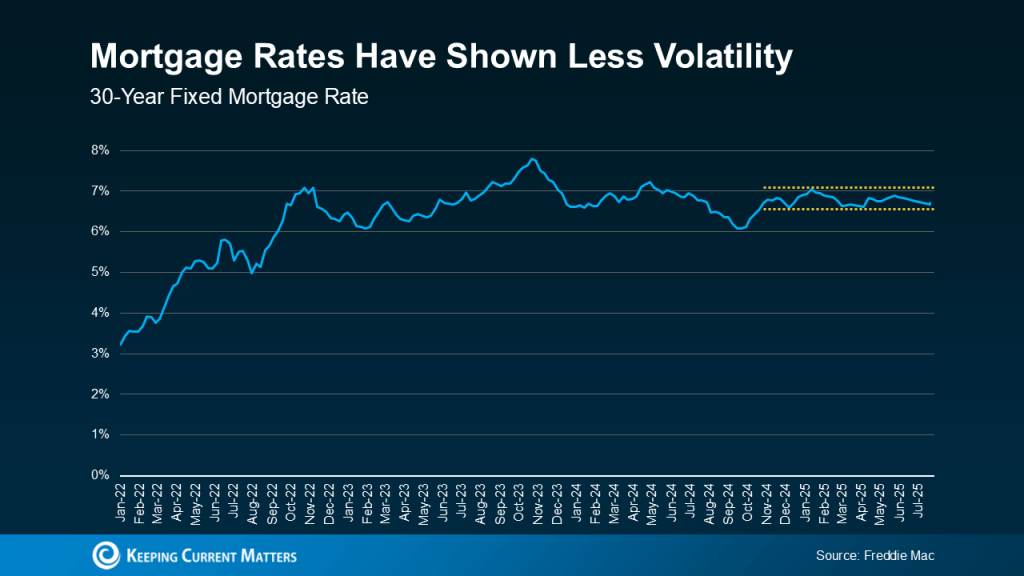

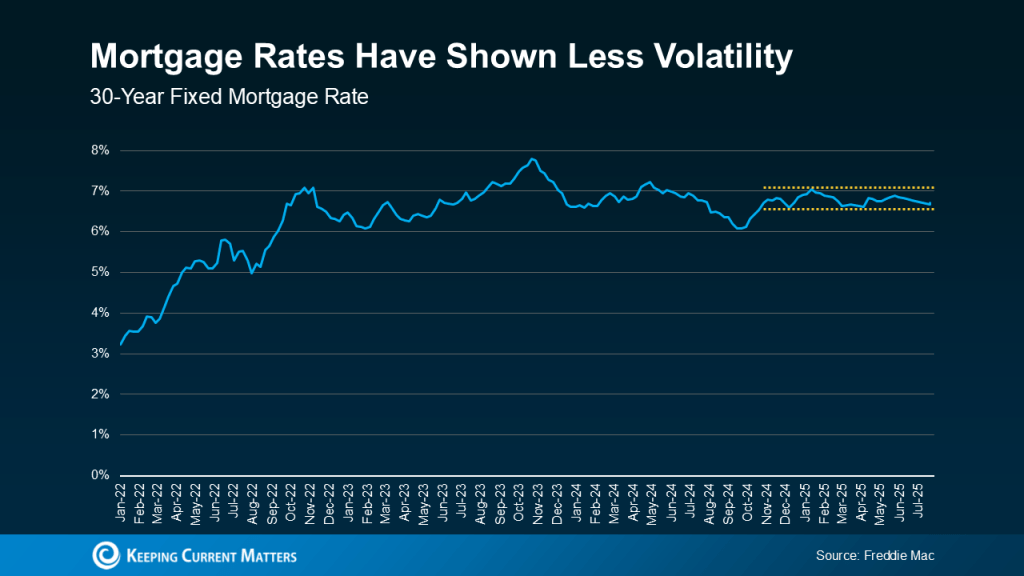

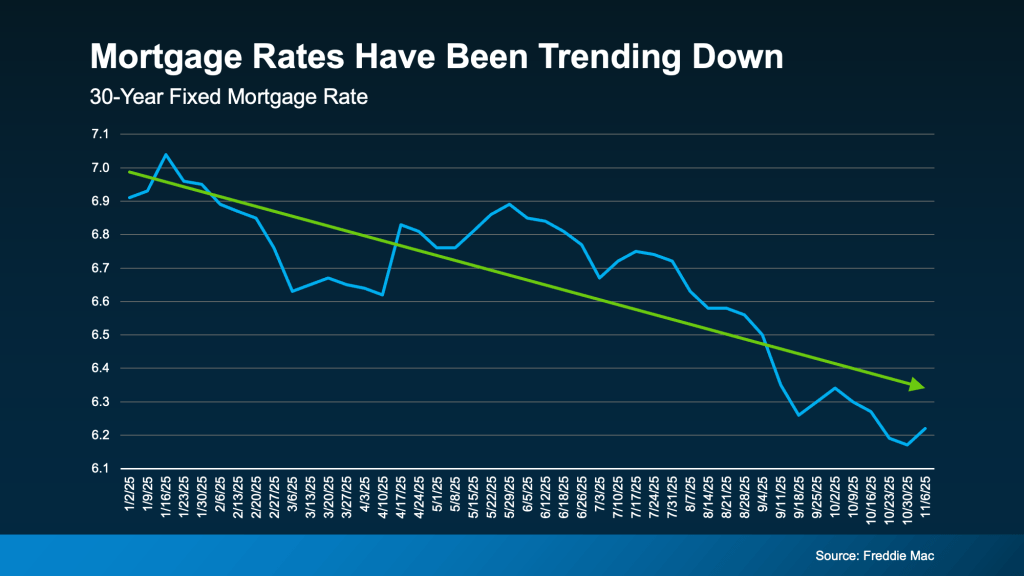

1. Mortgage Rates Have Been Coming Down

Mortgage rates are always going to have their ups and downs – that’s just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Here’s why that matters for you. This shift changes what you can actually afford. It means lower borrowing costs and more buying power. Take this as an example.

2. More Homeowners Are Ready To Sell

For a while, many homeowners stayed put because they didn’t want to give up their low mortgage rate. That “lock-in effect” kept inventory tight. And while plenty of homeowners are still staying where they are today, the number of rate-locked homeowners is starting to ease as rates come down. Life changes are becoming a bigger part of what’s driving more people to move, and that’s opening up more inventory.

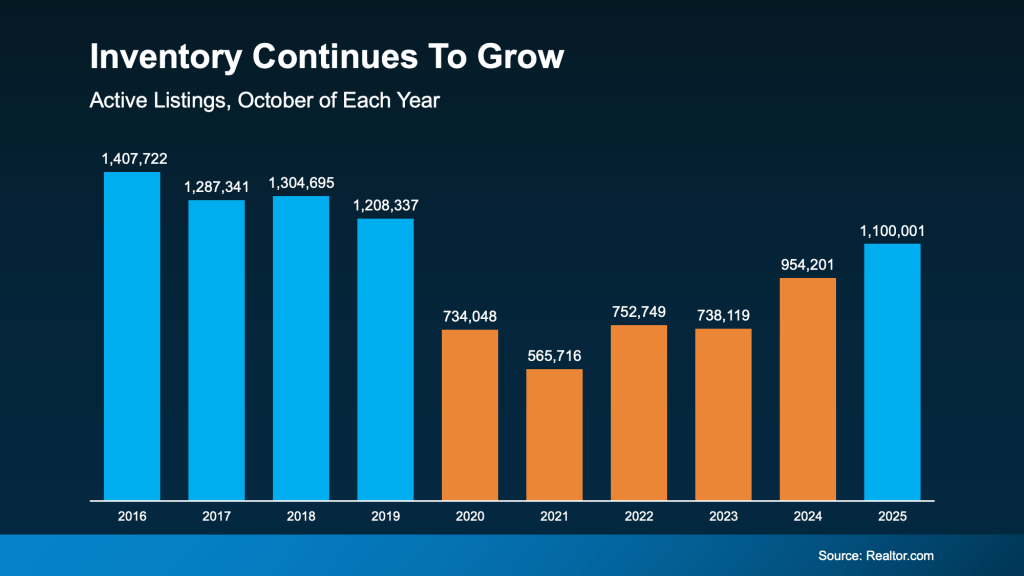

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

3. More Buyers Are Re-Entering the Market

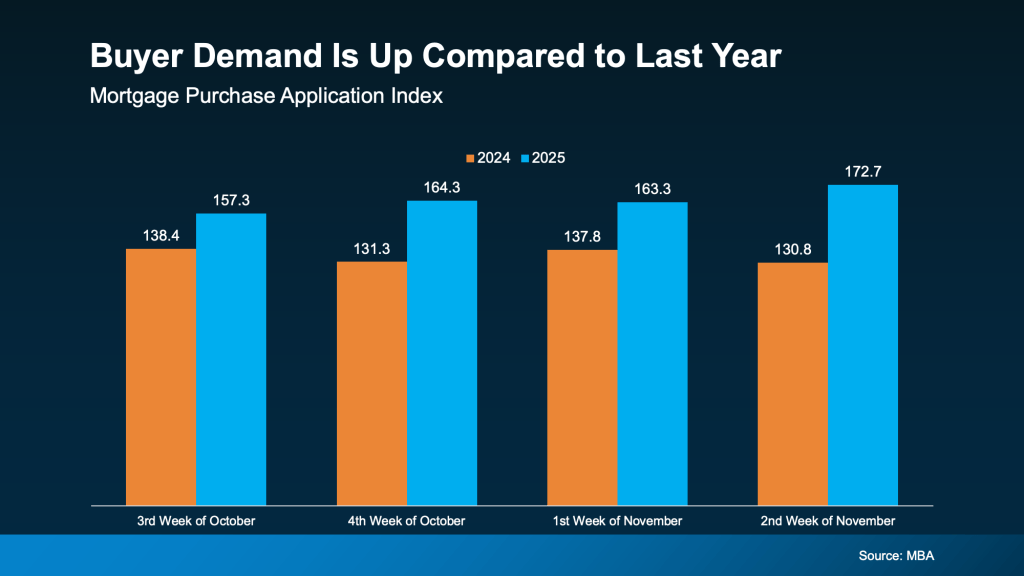

And it’s not just sellers making moves. With more options and slightly better affordability, buyers are getting back in the game, too. The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

Bottom Line

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

So, no matter what Uncle Bob may tell you, this really is a good time to take action and make the change you know you need to.

Please enjoy the holiday with family and friends.

…and if you’d like we’ll talk to Uncle Bob!

Mari and Hank

Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.