If you’ve been thinking about downsizing to lower your expenses, be closer to family, or just make life easier, here’s a trend worth paying attention to:

More homeowners are buying their next house outright, without taking on a new mortgage. And, if you’ve owned your home for a while, you may be able to do the same. No mortgage. No monthly housing payments.

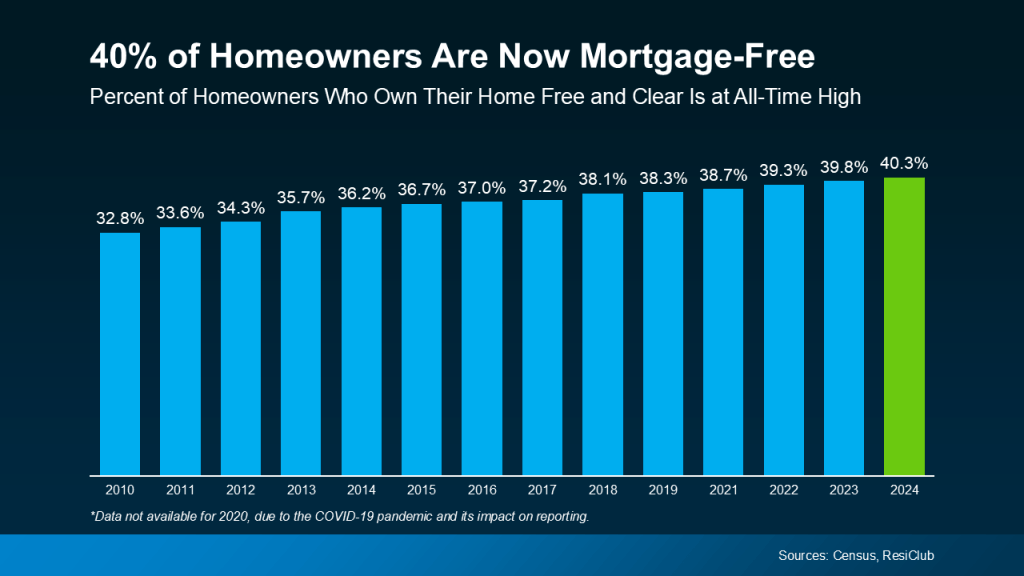

A Record Share of Homeowners Are Mortgage-Free

According to analysis from ResiClub of Census data, more than 40% of U.S. owner-occupied homes are mortgage-free – an all-time high for this data series. That means 4 in 10 homeowners own their homes free and clear (see graph below):

One big reason for this trend? Demographics. As Baby Boomers age and stay in their homes longer, many have had the time to fully pay off their mortgages. You might be in that group too and not even realize just how much buying power you now have. It’s time to change that.

How Downsizers Are Turning Equity into Buying Power

As a homeowner, your equity is your biggest advantage in today’s market. If you’re mortgage-free (or close to it), it could give you the power to buy your next home in cash. That means you’d still have no mortgage payment in retirement, plus:

- Less financial stress as you age

- More cash flow, if you purchase a less expensive home

- And it would likely be a faster, simpler transaction

Here’s how it works. You’d sell your current house and use the proceeds to buy your next house in cash. And while that may sound like something you thought would never be possible for you, it’s more realistic than you may think.

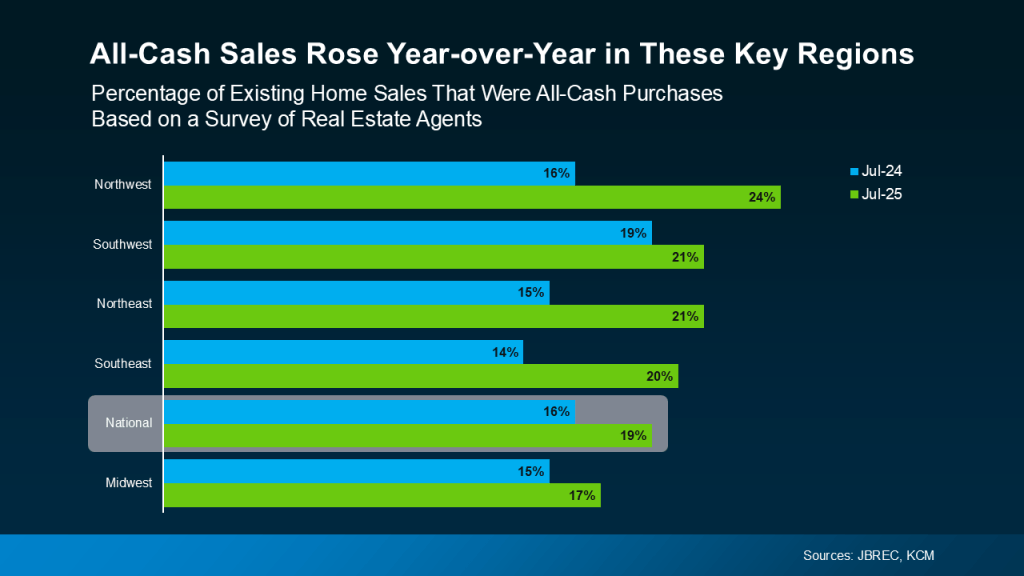

In the latest survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM), agents reported the share of purchases with all-cash buyers is climbing nationally. And those agents are seeing increases in almost every region of the country (see graph below):

For Baby Boomers especially, buying in cash gives you more control over your next chapter. You could buy a smaller, less expensive home and have lower costs, less upkeep, and more flexibility to enjoy what matters most. All while staying debt and stress free.

Because downsizing isn’t about downgrading your home. It’s about upgrading your quality of life. And that’s something worth exploring.

Bottom Line

You’ve worked hard for your home. Now it might be time for it to work hard for you.

Let’s talk about what your house is worth, and how that could fund where’s next for you. You can find us at 508-388-1994 or msennott@todayrealestate.com.

There’s no need to stay in your current home that is too big, too small, or not where you want to be because you think you can’t afford to move.

Mari and Hank

Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.